We know one of your major challenges in managing F&B retailers is cash flow. For some F&B retailers, the holidays impact of high and low season maybe much more visible than others. From constantly thinking of creative ways to bring in more customers to leveraging on Slurp! cloud to anticipate your slow season and plan for it, F&B retailers are constantly looking for opportunity to maintain a healthy cash flow.

In some cases, F&B retailers are reaching out to banks for short term working capital loan to help with their cash flow challenge during low season. In the last couple of years, we have seen banks in Malaysia taking a proactive approach in engaging SMEs to help them manage their cash flow, business assets & debts with greater ease.

Slurp! has recently teamed up with Maybank to help Slurp! merchants with their cash flow challenge. Maybank is offering a convenient and no-frills current account for Slurp! merchants, which is Maybank SME First Account (Business Current Account) with protection plan include SME Clean Loan (working capital loan with no collateral) for Slurp! merchants.

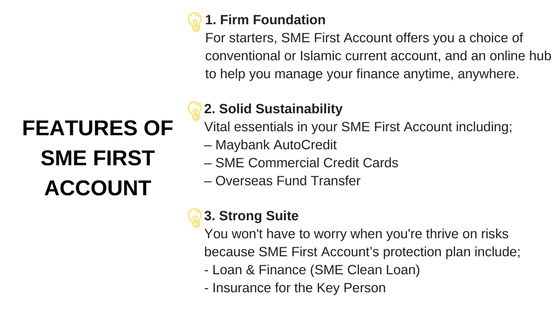

What is SME First Account?

SME First Account is a business current account/Mudarabah Investment account which comes with other solutions that suit your business needs.

So…..what is SME Clean Loan?

It is designed to boost your company’s working capital by providing fast cash with no collateral required, so you’ll never miss a business opportunities.

Faster approval time-frame for SME Open Account application and Working Capital Loan with no collateral is offered by Maybank specially for Slurp! Merchants