Recently Bank Negara is pushing on for a cashless society. Since then, we have seen a sudden influx of multiple service providers offering their various digital wallet solutions for retailers. Their latest technology offerings are beneficial to push towards a cashless society. However, it would be useful for merchants to have a more comprehensive information on how this works. Before we jump into the further details of each service providers, let’s take a look at how cashless society affects overall F&B retail businesses.

Malaysia in general is still a cash heavy society. However, the trend is changing given the recent blueprint issued by Bank Negara which one of the nine focus is on electronic payments.

In many ways, we have seen this trend impacting our personal lives. For instance, a quick tap on your mobile phone, enables you to buy items from Lazada. Oftentimes at a cheaper price and shipped directly to your doorstep. Saving the hassle of going to the mall to buy the same item.

How does this impact you as a F&B merchant?

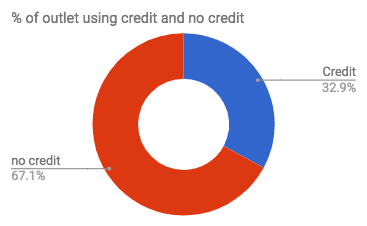

A quick look in our internal data shows that 32.9% of Slurp’s customers accept digital wallet payment method, while the other 67.1% are still hesitating.

Of the 32.9%, we found that their average ticket size is approximately RM49 per receipt, which is 3x more than outlets whom does not accept cashless payment method. This translates into a contributing factor of their total revenue per month as well.

Merchants’ top two concern on adopting digital wallet payments method would be cash flow and cost of implementation. Many service providers are competing with each other on the above as an added incentive to draw merchants to accept cashless payments method.

Who are the service providers in town? And, how do they differ?

1. Boost Mobile Wallet

- Backed by one of the largest regional Telco company, Boost digital wallet has acquired 500,000 users in Malaysia alone since it’s launch early this year.

- The digital wallet feature will be launched in early Q4 2017. It will focus on young adults and college students, enabling them to make payment at their favourite merchants via their mobile phone.

- Merchants can easily accept payment via a static/dynamic QR code method.

2. FavePay

- A spinoff feature from Groupon/Fave vouchers, FavePay offers merchants a way to incentivise their existing customers with cashbacks and encourage them to revisit.

- Easy deployment format has enabled many merchants to adopt FavePay easily in Malaysia.

- FavePay had been adopted by major brands like Auntie Anne’s, llaollao, Juice Works, etc.

3. GHL-AliPay (via airpos solution)

- Airpos is GHL’s mobilePOS solution that accepts credit/debit and now even AliPay payments.

- With AliPay, merchants can capture a share of the payments from any of the projected 3 million Chinese tourist for 2017

- GHL’s solution is suitable for F&B merchants who are targeting a one stop payment solution – credit/debit/AliPay

Interested to find out more on each of the service provider above?![]()