Government grant fundings for SME in Malaysia are available for your business to recover. Is your business still struggling to pull out of troubles following the current pandemic situation?

If your business is still surviving during this period, you always have a chance to recover so let’s grab this opportunity!

This is a huge task for SME owners as they have to make some tough decisions for the sake of the business.

One of the common problems for SME Malaysia is the lack of funding. As we all know, not every business has the necessary amount of money to stay alive during this time.

Lucky for you, there are fundings opportunities for you to grab. Scroll down to find out more about the details.

What Can Be Done To Improve The Situation?

Early in 2020, nobody would have expected that a pandemic would put their business in serious jeopardy.

When the Movement Control Order (MCO) was announced back in March, SMEs immediately faced difficulties and some even went out of business.

As a result, many entrepreneurs found themselves hanging by the skin of their teeth, barely surviving.

However, this is not the end of the world for SME owners. There are ways to keep your business running.

One of the ways is to ensure that communication within the company is clear. During the MCO, companies had to turn to communication channels to conduct meetings and discussions.

This shows that regardless of the situation, communication is key as ideas and solutions may arise to handle situations like this.

Therefore, make sure that all of your employees to be on the same page. This will give you a glimmer of hope to recover from the impact of COVID-19.

The other alternative that you should really consider is looking for financial fundings from the government.

Back in April, following the announcement of MCO, the government announced that SMEs will receive fundings worth RM10 billion.

This should be music to the ears for SME in Malaysia as this will absolutely help their business to survive.

How To Get The Government Grant Fundings?

In order to get the fundings, you have to apply for one. There are plenty of fundings for you to choose from and apply.

Firstly, there are various types of grants for different target groups and services. Hence, you have to identify the one that you can apply.

- SME Emergency Fund (SMEEF)

- Business Start-up Fund (BSF)

- TEKUN Financing, Rural Economy Funding Scheme (SPED)

- Soft Loan Schemes for Services Sector (SLSSS)

- Soft Loan for SMEs (SLSME)

- Tabung Usahawan Siswazah

- Young Entreprenuer Fund (YEF)

- Tabung Pembangunan Pengangkutan Awam (TPPA)

- Bumiputera Enterprise Enhancement Programme (BEEP)

- Skim Kredit Pengeluaran Makanan (SKPM)

- Rural Economy Funding Scheme (SPED)

- PROSPER Usahawan Muda (PUMA)

Once you get that done, you have to make sure that your company is eligible to receive the fundings.

You can do that by reading the requirements for each funding scheme because different schemes have different conditions.

If you are running a start-up technology-based business, there is a Business Start-Up Fund (BSF) that can help you financially.

Young and eager to kick start your business? There is PROSPER Usahawan Muda (PUMA) to help you.

The point is you should know that there are fundings out there that can help your business.

If you are eligible, you are highly encouraged to apply for fundings by contacting the agencies concerned.

Benefits Of Having Government Grant Fundings For SME

Government grant fundings for SME are not like a loan where you are required to pay back.

Consider this as getting free money for your business. With this money, you get to put some pressure off your shoulder especially during times like these.

It can do a lot of things for your business such as retain your workers and handle many more financial problems.

Interestingly, government fundings are available in many types of categories of business. From food to public transportation, you name it.

If you are in the food industry, you can apply for Skim Kredit Pengeluaran Makanan (SKPM).

The same goes for every business where they have a different scheme to support their business.

As mentioned, before applying, check the eligibility requirements.

Because this is a government initiative to help SMEs, you should grab this opportunity.

Conclusion

In conclusion, nothing is guaranteed in the business world.

The current COVID-19 situation proved just that. You have to act quickly to overcome any sort of obstacles because business is a risky industry to be involved with.

Government grant fundings for SME Malaysia is a huge boost to recover financially.

So, do not miss this chance to save your business once and for all because having a good start in managing your business is vital because operating it is a challenging task.

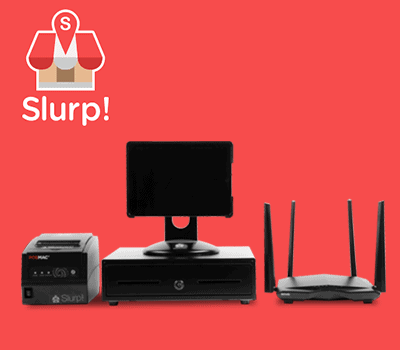

Slurp! POS Inventory Management helps you to get your business going smoothly because you can analyse your business budget, sales tracking, and also cash flow.

Our POS system is a more attractive prospect compared to the ordinary cash registers.

You will get to enjoy 30% of profits with our POS system.

Read more on how to increase your profit here, here, and here.

Now, you have learned the significance of POS Systems. The question is which post system best for your F&B business?

Time To Check Out Your Free Trials Here!

If you have any inquiries, you may contact us through our website. Visit our Facebook here.